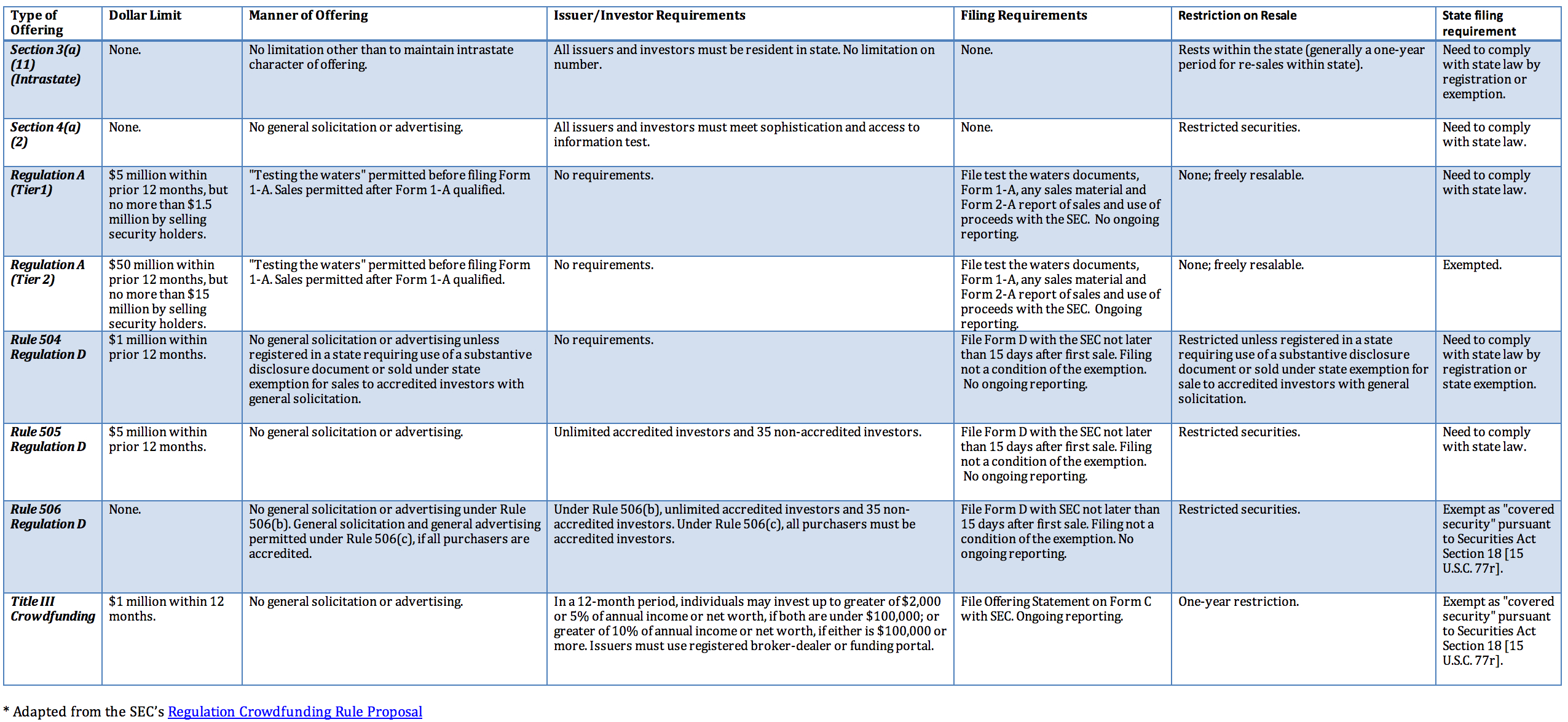

Let’s say you have started/built this really great business that needs funding right now to launch, survive, expand, take it to the next level, etc. If you are not ready for an I.P.O. yet, and the “ready-for-prime-time” state that is a pre-requisite, I have good news—times have never been better, legally speaking. There have never been more options for private companies to get financed, whether though Regulations D or A, or new Regulation Crowdfunding. Some of the options have been around for a long time and may have been just been made easier (enter the JOBS Act), and some of them are brand new (JOBS ACT again). The chart is meant to show you the lay of the land for private offerings at one glance (simply click on the chart to make it larger):

One note: The rules for JOBS Act crowdfunding and expanded Regulation A are not final yet. The comment period ended in February, so we expect final rules later this year. I will keep you posted.

Two other important things to keep in mind: 1. All offerings are subject to the anti-fraud rules of the federal securities laws and 2. Every state has its own securities laws, which may apply in addition to the federal rules that are outlined above depending on the offering. In some cases, securities that are exempt under federal law may not enjoy the same treatment under state law.

With all the alternatives out there, spend the time to go through the cost/benefit analysis and find the alternative that suits you best, depending on the amount you intend to raise, the nature of potential investors you have access to, your existing infrastructure, your trajectory etc. Go for it.

As always, if you have questions or comments, please call, e-mail or tweet me @Bettina Eckerle.

Eckerle Law offers legal advice in a variety of transactional and regulatory matters and serves companies’ plenary business law needs. Its founder, Bettina Eckerle, is a veteran of Debevoise & Plimpton and Wachtell, Lipton, Rosen & Katz. She also served as the General Counsel of two companies en route to IPO. Please visit the Eckerle Law website for more details.