When the SEC‘s proposed new rules for Regulation Crowdfunding came out in October last year, there was understandably a lot of excitement. What’s not to love about the lofty idea of providing companies access to the huge reservoir of investable assets previously untapped and the street access to investment opportunities previously out of reach.

When the SEC‘s proposed new rules for Regulation Crowdfunding came out in October last year, there was understandably a lot of excitement. What’s not to love about the lofty idea of providing companies access to the huge reservoir of investable assets previously untapped and the street access to investment opportunities previously out of reach.

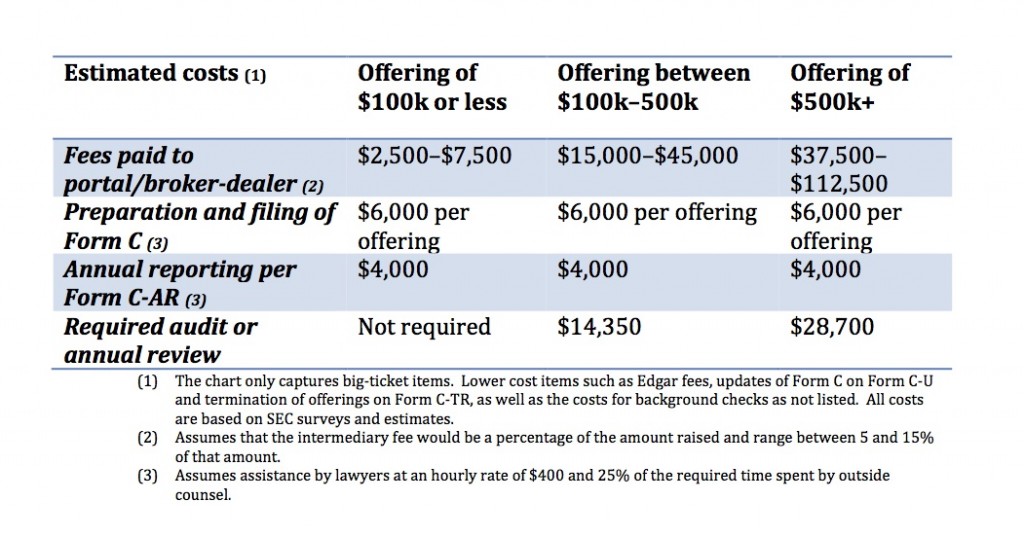

Then, there are the realities of an actual campaign, including its cost/benefit analysis. I would urge companies at the fundraising stage to spend time and thought determining whether a campaign equity-crowdfunding-style makes sense or whether an alternative is more viable. In the rule proposal, the SEC presented its own cost/benefit analysis. I thought it might be helpful in your decision-making process. Here are the main elements:

- Broker-dealer/funding portal fees. Selling of crowd funding securities need to take place through an intermediary, i.e. a broker or funding portal, which will charge a fee presumably based on the size of the offering.

- Costs of preparing and filing Form C with the SEC. The new rules require the filing of a Form C for each campaign. The Form includes a description of the business and a business plan, financial information, and information about the issuer’s directors, officers and owners.

- Costs of preparing and filing an annual report on Form C-AR. Issuers need to file an annual Form C-AR on an ongoing basis.

- Costs of financial audits/reviews. The issuer’s financial statements must be reviewed by an independent auditing firm for campaigns between $100,000 and $500,000, and audited for campaigns of $500,000 to $1 million.

- Costs of criminal and regulatory background checks. Issuers must perform background checks on any director, officer, general partner or managing member of the issuer, as well as any promoter and owner of 20% or more of the issuer’s voting shares.

Overall, the SEC predicts that the regulatory costs associated with a crowd funding campaign may be as much as 12.9 to 39% of the funds raised for campaigns of less than $100,000. No need to say more. But even for larger campaigns, there may be alternatives out there that are more suitable for reaching your goal of obtaining sufficient funding with a cost/administrative structure that makes sense in light of your specific situation.

Don’t get me wrong — I still believe that crowdfunding will play an important role in the fundraising process for start-ups and small companies. But I also believe that there are, or soon will be, a number of attractive alternatives out there — the JOBS Act modernized tried-and-true Regulation D and is intent on reviving Regulation A — that may provide a more efficient way of funding with your specific goals and prospects in mind. Take the time, sharpen the pencils and do your homework.

I’m writing a separate post laying out the alternatives to help you with the process. Stay tuned. In the interim, please call, email or tweet me @Bettina Eckerle with questions or comments.

Eckerle Law offers legal advice in a variety of transactional and regulatory matters and serves companies’ plenary business law needs. Its founder, Bettina Eckerle, is a veteran of Debevoise & Plimpton and Wachtell, Lipton, Rosen & Katz. She also served as the General Counsel of two companies en route to IPO. Please visit the Eckerle Law website for more details.